I was a young 25-year-old employee a long time ago. I made so many investment mistakes from buying things I did not need and listening to hot stock tips. Through the years, I did learn several lessons. My whole career revolved around investments, hence learned how to manage money. Now that I’m a father of two boys, I wish to impart learnings upon them as they grow up. I hope they will carry these out when they start their own families, just like what my dad taught me before he passed away.

In investing, setting your short-term and long-term financial goals are key. Being young means you have the #1 factor, which can help build wealth – time. A long horizon means you can afford to invest aggressively and take on more risk. With so many things to learn about investments, it may seem daunting to even know where to start.

Don’t fret, I know how you’re feeling. Here are some practical saving and investment tips, which I have learned and practiced for over the past 20 years:

- Take advantage of your company’s workplace savings plans

Make the most of your monthly salary deduction and forced-savings programs. This allows you to build your savings over time through investments in bonds or equity funds. Most companies have this in the form of a Retirement Defined-Contribution Plan / Provident Fund / Group savings plan which allows member voluntary contributions. Sometimes these companies even match your contributions up to 100%. That’s free money! (SLAMCI offers a workplace savings program for its corporate clients called Sun RISE – Regular Investments Simplified for Employees).

- Join your company's COOP (Multipurpose cooperative)

COOP contributions can be under salary deduction and their annual dividend returns have averaged around 6-8% net.

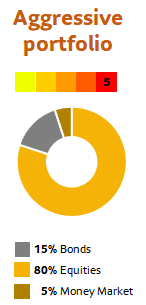

- Maximize your potential to build wealth by having an Aggressive Asset Allocation investment portfolio.

Asset allocation involves dividing an investment portfolio among different asset classes such as stocks, bonds, and cash.

This is how it will look like: 80% equities/equity funds for capital growth, 15% bonds for fixed income, and 5% cash for emergency funds. Studies have shown that most of the long-term performance is determined by asset allocation.

- Cash: Build an emergency fund in your cash portfolio of at least 3-6 months’ pay. Put this in a high yield savings account or Money Market Fund to at least beat inflation. This may come in handy for unexpected expenses or emergencies. (SLAMCI recommends the Sun Life Prosperity Peso Starter Fund)

- Bonds: Earn passive income from your bonds portfolio, which provides a fixed schedule of interest income payments. These vary from semi-annual to quarterly payments. Instruments such as Retail Treasury Bonds (RTBs), corporate bonds/notes, and government securities (FXTNs) are generally low-risk and provide regular fixed interest payments that can supplement your income from employment.

- Equities: Grow your wealth over time through equity funds. Let professional fund managers handle your money through mutual funds, which give you access to a basket of stocks for as low as ₱1,000 only. Love your own by investing locally in our stock market via the PSE equity index funds. If you want to invest in tech companies such as FAANMG stocks (Facebook, Apple, Amazon, Netflix, Microsoft, & Google), invest through feeder funds, which can invest your pesos into global funds that have these stocks as top holdings. Global feeder funds invest in the US S&P 500 or the MSCI All-Country World Index. (SLAMCI recommends the PSE Index Fund and World Equity Index Feeder Fund).

- Automate your savings

You can do this via a regular auto-invest debit-arrangement or online scheduled bills payment with your bank. This is a convenient way to regularly invest by using cost-averaging, which is a popular investment strategy wherein one invests a fixed amount at a regular schedule, thereby reducing the risk of investing a large amount at the “wrong time”. (SLAMCI offers its Auto-Invest ADA, online bills payment programs with several big banks)

- Invest more during times of crisis.

Looking back at the 1998 Asian financial crisis and the 2008 global financial crisis, history has shown that investors who came in during market crashes with a long investment horizon were greatly rewarded years later. It’s during these times where real wealth is built over time.

- Separate your money for active stock trading (buying & selling) from your main investment portfolio.

Actively buying & selling of stocks for fun can be very risky, money here should be separate from your main investment portfolio, which is for your long term goals. Remember that money you use for stock trading is money you are ready to lose.

- Protect your health and wealth with a good insurance plan.

Doing so allows you to live a brighter and more secure life, knowing that you are covered in case any serious illness strikes. Get insurance while you’re young because you can get a policy relatively cheap. Term insurance would be the most affordable. If you are able to, get a Variable Universal Life (VUL) insurance, which has an investment fund linked to it. This can also help build wealth over time (Sun Life recommends SUN Maxilink Prime). If there’s anything we can learn from this pandemic, it’s that health is wealth. Fortunately, there are specific products that can give you funds in case of sickness. (Sun Life recommends SUN Fit and Well).

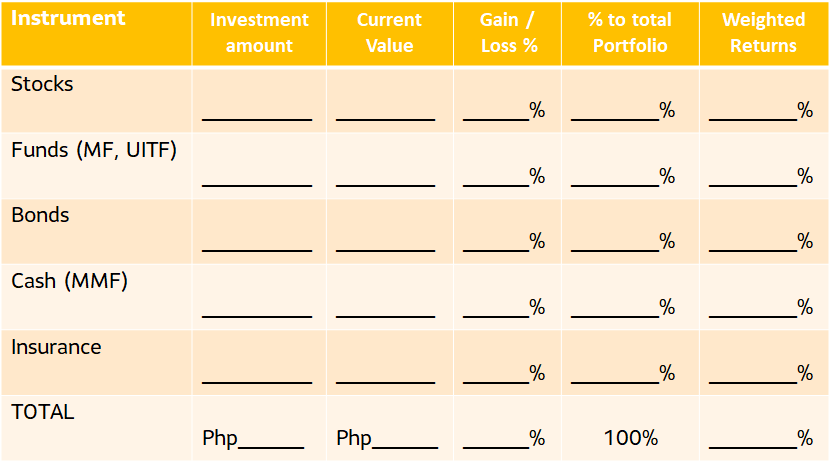

- Monitor your total investment portfolioin a spreadsheet, segregate all your asset classes into stocks, funds, bonds, deposits, cash, and insurance plans. List down all their investment amounts, current value, and returns. Put percentage weights on each asset class in relation to the total portfolio amount (e.g.: Equity Funds 80%, Bonds 15%, Cash 5%). Compute for the weighted return for your whole portfolio. This will help you know where you stand at any given moment and to see where you want to be in the future. Review at least every quarter or upon any major changes to the portfolio.

They say hindsight is 20:20 and I wish I knew all these things when I was 25 years old. Investing isn’t all about the highest returns. The main focus should be on achieving your financial goals through proper asset allocation. Investing is also about having a long-term mindset, managing your risk, and getting to know your investing style. It’s the size and consistency of the contributions to your investments which will help you achieve your financial goals the fastest - not necessarily the returns. What you do now will determine your future portfolio. Learn and keep learning. Don’t invest in anything you don’t understand. With so many digital online tools and platforms now, investing is fun as it should be. Need to know more? Speak to a financial advisor. Happy Investing!

.png)