Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://online.sunlife.com.ph/privacy. By continuing to browse our site, you are agreeing to our use of cookies.

Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://online.sunlife.com.ph/privacy. By continuing to browse our site, you are agreeing to our use of cookies.

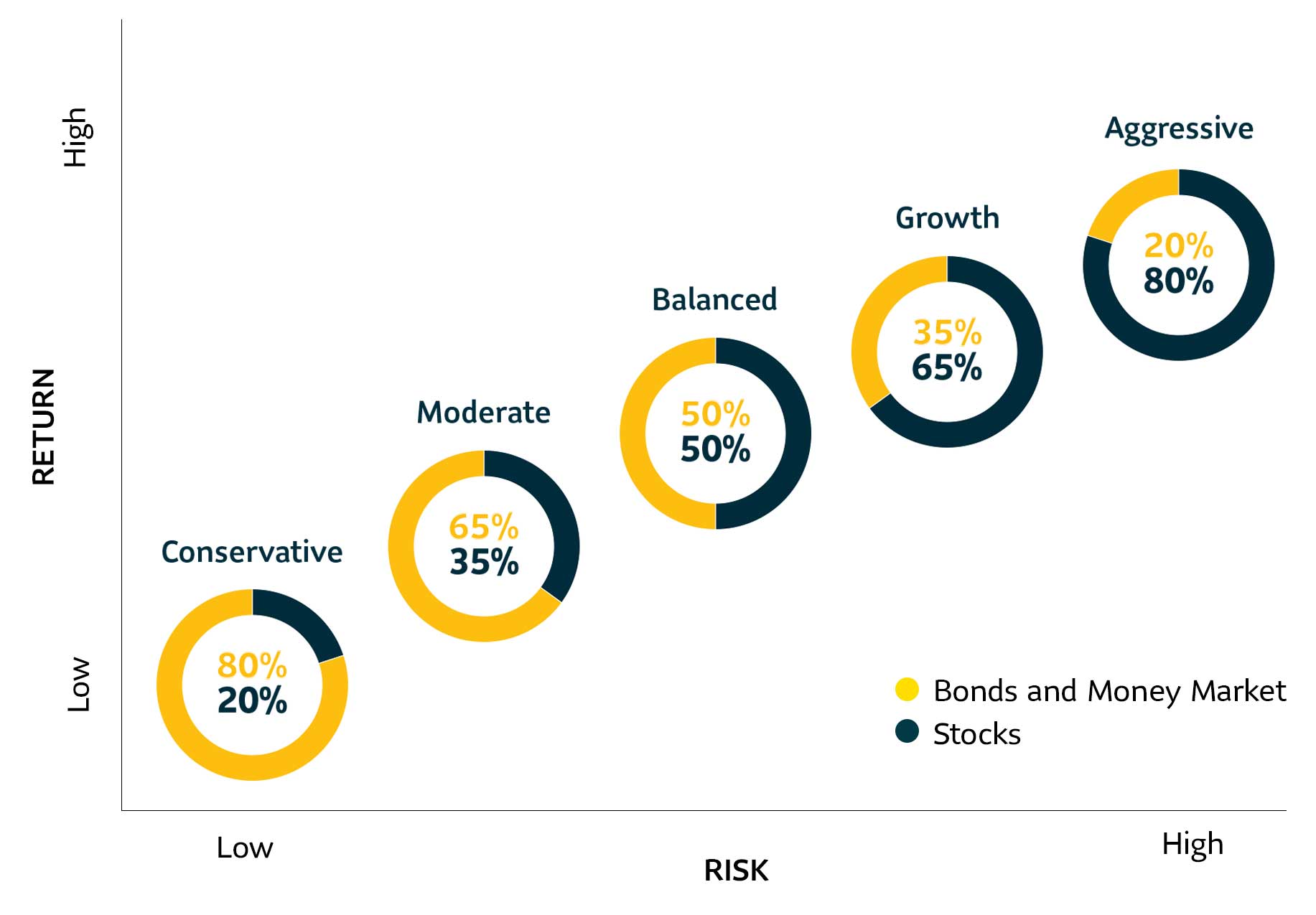

Worried about market volatilities that may get in the way of your financial goals? A strong and goal-oriented investment portfolio is your best defense! Our recommended investment portfolios are designed for various investor profiles.

Check out this guide and start building your own with Sun Life Asset Management.

The first step is to find out your investor risk profile. Your financial needs and capacity will determine the right investment mix for you.

|

Risk Profile

|

Profile Description

|

Latest Portfolio Fact Sheets

|

|

You prefer a predictable flow of income or have a short investment horizon. You have a low tolerance for price fluctuation and your primary goal is to keep your capital.

|

||

|

You seek stability and a regular flow of income, but you would also like to grow your capital over time. You have a mild tolerance for price fluctuation and your primary goal is to keep your capital while also earning some income.

|

||

|

You are looking for long-term capital growth and a stream of regular income. You seek stable returns, but are ready to accept some price fluctuation. You understand that growing your capital requires a little risk.

|

||

|

You can tolerate substantial price fluctuations. You understand that equities are high-risk investments with high potential returns. However, you do not want all your investments in equities. You're looking for long-term capital growth with some income.

|

||

|

You can tolerate significant price fluctuations in the value of your investment. You prefer high-risk investments with high potential returns, and are not bothered by potential losses. You're looking for long-term capital appreciation and do not mind volatility.

|

The asset allocation strategy may help you achieve more stable returns* for the level of risk you are willing to take.

*Past performance does not guarantee future performance.

Note: Clients who will open an account online or via the individual account opening form (physically or digitally) will initially see three (3) risk profiles only (Conservative, Moderately Aggressive, and Aggressive) due to ongoing system enhancements. Our system, online tools, and forms will soon reflect the five (5) risk profiles (Conservative, Moderate, Balanced, Growth, and Aggressive). For questions or assistance, kindly consult your Sun Life Mutual Fund Advisor. Thank you.

LEARNGet to know the market with the help of your trusted Sun Life Financial Advisor. |

|

DIVERSIFYAvoid relying on one stock, sector, or asset class only. |

|

REBALANCEAssess your portfolio regularly to align it with your changing needs. |

The Sun Life Prosperity Funds were created with the Filipino investor in mind. Discover how our funds can work for your needs.

alt="Sun Life Asset Management Investor Profile graoh"

alt="Sun Life Asset Management Investor Profile graoh"

To know more about which funds suit your investment needs, consult your Sun Life Financial Advisor. No advisor yet? Connect to a Investments Advisor now.

Disclaimer: This material is for your reference only and does not constitute advice given by Sun Life. Please review your financial needs depending on your personal situation and objectives.