Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://online.sunlife.com.ph/privacy. By continuing to browse our site, you are agreeing to our use of cookies.

Important notification on data privacy and cookie notice

We use cookies to ensure you get the best experience on https://online.sunlife.com.ph/privacy. By continuing to browse our site, you are agreeing to our use of cookies.

You Are Invited

As part of our goal to help you become one step closer to achieving your dreams and become lifetime partners for prosperity, Sun Life Asset Management Company, Inc (SLAMCI) invites you to attend our collection of events that aim to help you learn the basics of investing, better understand what mutual funds are and finally, build brighter future towards total financial freedom. Register to any of our events today!

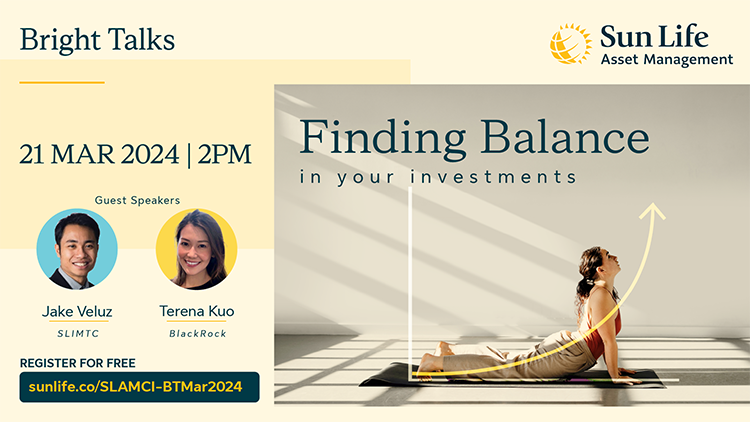

About the Event:

From yields to upward gains, finding the right balance for your portfolio is critical.

Strengthen your financial fitness with our free webinar on March 21, Thursday, 2pm with Vice President of Blackrock Terena Kuo and Sun Life Investment Management Global Funds Portfolio Manager Jake Veluz.

Together, let us learn how investing in different asset types can help achieve your financial goals.

Missed the recent webinar? Catch up here!

Key Takeaways

Source: Sun Life Investment Management and Trust Company Mid-year Market Outlook

OUTLOOK

Fixed Income

Equities

Market Opportunity Ahead

Fixed Income

Equities

Risk to These Views

Fixed Income

Equities

Source: Sun Life Investment Management and Trust Company Mid-year Market Outlook

Market Opportunity Ahead

What should be your behavior as an investor

On being risk-averse

On being over-confident

Right Biases for Investing

What You Should Do

Source: Jimmy Weng, Head of Equities, Asia - JP Morgan Asset Management

Market Opportunity Ahead

What It Means for Your Investments/Savings

What You Should Do

Source: Jimmy Weng, Head of Equities, Asia - Sun Life Assurance Company of Canada

How These Affect Your Investments/Savings

What You Should Do

Source: Andrew Gan, Managing Director - Beacon Holdings Inc.

Disclaimer. This material is for your reference only and does not constitute advice given by SLAMCI. Please review your financial needs depending on your personal situation and objectives.

About the Event: MF101 session connects you to the basic concepts and ideas of investing in mutual funds (MF) to help you understand how MF investments work and how you can benefit from it into becoming bright investors of tomorrow.

About the Event: Narrowing your options to the best fund that suits your need may be a challenge for some. In Fund in Focus sessions, we help you understand the nature of each featured fund, its risks, earning potential, and how it can answer your investment goals.