The Philippines is a highly entrepreneurial country. The main reason why most of us venture into small businesses is because majority of its citizens live below the poverty line. Starting a small business is one way to start one’s journey to accumulate and build wealth. There are a lot of small businesses opportunities that one can take, like an eatery, internet cafe, bakery, floral shops, to name a few. But choosing one that will surely be profitable and successful is a whole different story.

Usually, it takes time or years to establish a particular business. You need several components to make that happen:

- Capital: To practically finance and jump-start the business. This could be in a form of borrowings or loan.

- Time: Ideally, you need to dedicate yourself to fully-supervise your business operation

- Technical “know-how” : How well do you know your product line? If it’s a restaurant, how much do you know your chosen cuisine?

- Target Market: To whom do you cater your product? Profiling is also important to identify your potential customers

Remember, aside from the components mentioned above, you should have a real personal interest and passion in the business you will engage in. A business succeeds or fails based on the owner’s commitment and ability to execute and manage his business plans well.

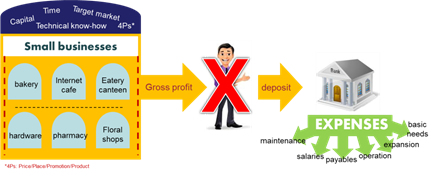

This is how a normal business cash flow works: See figure: 1

Using the above illustration, normally the gross profit/sales is placed in the bank as an avenue for safekeeping and essentially being used to address business expenses such as: maintenance, salary of the employees, supplier payables, other business operations, possible expansions and of course your basic needs in life.

Also, small business owners also consider insuring their premises and other equipment as part of their risk management approach but for some reason, some fail to protect their own income – an income being generated by the business owner himself. The consequences can be terrible.

For some, it may sound like a cliché, but it is a fact that life uncertainties may happen at any given time - - like untimely death, accidents, getting disabled and people do get ill. It's very important to plan to protect against the financial hardship this could cause to you or your family, particularly if you are a small business owner who depends mostly in your business profit.

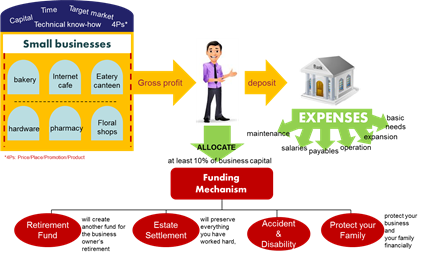

The basic question is: What if the owner is taken out of the picture? See figure: 2

If this happens, the entire business interest gets affected. The business interest may have been secured and well-managed but what about business owner’s interest? What happens to the family in case he/she dies? What about the current expenses? Financial commitments and other expenses that may incur? Is this well-funded? Is this part of the business cash flow?

The following are some of the problems faced by small businesses:

1. Undercapitalization due to poor planning. This means not able to manage financially the business cash flow (inflow less outflows)

2. Business continuity due to uncertainties. This means any of the following: a) Available funds to continue the business, b) Immediate successor in case the business owner gets disabled/dies, or c) Funds to address liabilities, payables

3. Immediate cash in case the business owner dies.

- Estate settlement (the business will form part of the deceased owner)

- Probate cost

- Hospital expenses/Funeral

- Income for family

4. Most importantly, retirement fund for the business owner. Pay yourself first. Having enough money to fund your retirement even if you’re no longer running the business. Creating income resources is very important when you retire soon

How do we address these concerns? Here’s an idea: Protect the business by protecting the one who is running it - - Prioritize the business owner’s interest.

Having an income protection vehicle help business owners settle not just mortgage repayments or business expenses concerns (like estate liabilities, supplier payable) and other debts but it can also a source of income for your retirement needs. Please see figure 3 sample illustration.

Using the above illustration, set aside or use at least 10% of the business capital as a budget to be able to create a funding mechanism to help the business owner address financial worries in case of uncertainties. This process can also be labeled as some form of diversification - - Creating another outlet, spreading the risk and protecting the business, the business owner and his/her family’s well-being.

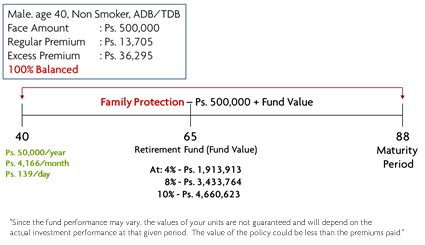

Using a sample Illustration: see figure: 4

- Small Business: Small Eatery/Foodcourt canteen

- Business Capital upon set-up: Ps. 500,000

- Budget for funding mechanism: Ps. 50,000 (10% of Ps. 500,000)

- Business Owner Profile: Male/Age 40/Non-smoker

- Sample Product Illustration: Sun FlexiLink Regular Pay

With only PHP 139/day, the cost of premium is not so high, we will be able to protect both business and business owner’s interest. Isn’t this a tiny amount only compared to what a business owner earns on a regular basis?

In summary:

- Having a business is one way to accumulate wealth

- Make sure you have the basic components to run your business

- Business may be a source of income to provided basic necessities/provide for the family ...

- BUT, take into consideration the uncertainties in life that without proper planning (that includes protecting the business owner's interest/family/business itself), financial hardship may be experienced

- Now that you are own boss and the boss of many, it only makes sense to protect both your family's income and the income of the people working for you.

Isn't this is something to think about? I'll leave the answer to you.

.png)