In order to reach your goals as planned and on time, savings won’t be enough. You need to make your money earn more by investing.

Ideal for:

| Getting Started | Moving Up | Preparing Ahead |

Concept of Investing

Make IDLE MONEY work to help your meet your financial goals.

- The returns are potentially higher than savings.

- The Objective is to beat inflation

- A small or big amount may produce rewards overs the long-term

Diversification helps lower the risk of losing capital

Diversification is a portfolio strategy designed to reduce exposure to risk by combining a variety of investments. It reduces both the upside and downside potential and allows for a more consistent performance under a wide range of economic conditions.

Investing Tips

- Know your investment goals or objectives

- Determine when you’ll need the money

- Identify the level of risk you can tolerate

- Make sure your portfolio is well-diversified

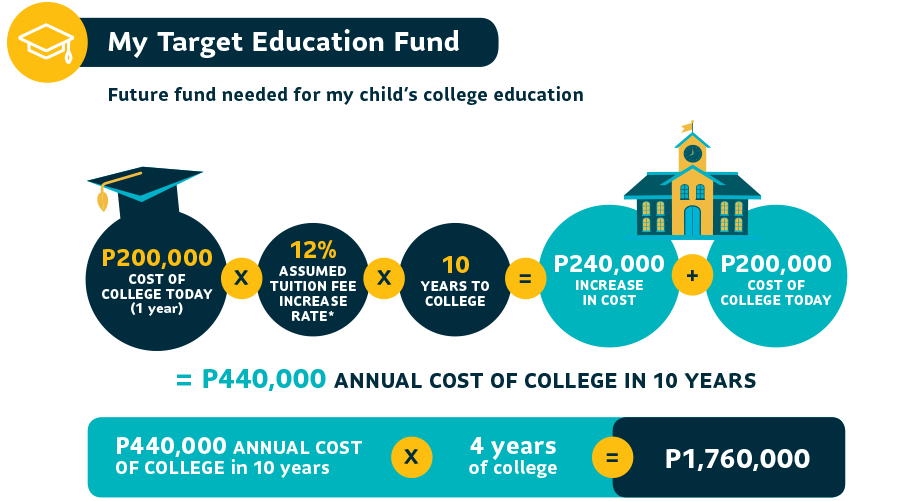

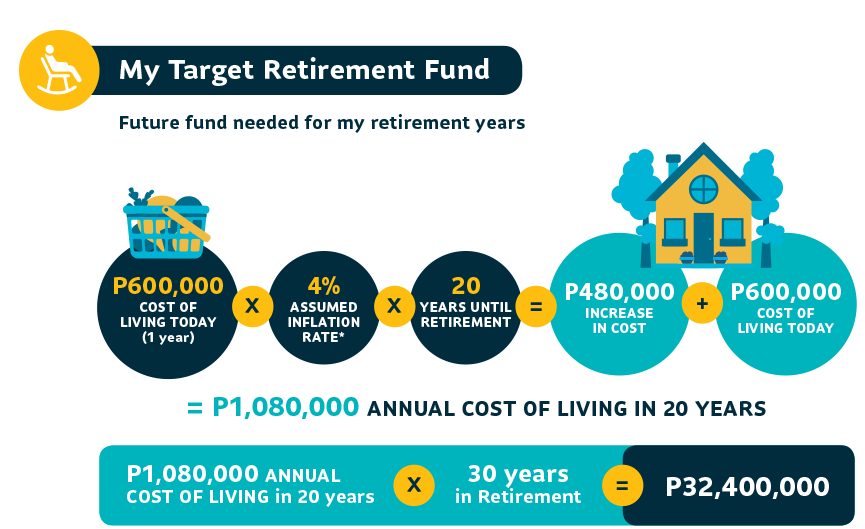

The money you grow can be used to fund your major goals such as the EDUCATION of your children, your RETIREMENT, or SAVINGS for other life milestones.

Always follow this rule of thumb:

- Compute by how much a goal today will increase* in the future

- Then, add the cost of goal today to #1 = TARGET FUND (at the minimum)

*No compounding of interest

Download the Target Education Fund worksheet here.

Download the Target Retirement Fund worksheet here.

Download the Target Milestone Fund worksheet here.

*The calculations are for reference and illustration purposes only and does not constitute a proposal indication or financial advice. Sun Life makes no representation or warranties as to completeness or accuracy, nor is it responsible for any consequent loss or damage that may arise from its usage. You may talk to a Sun Life Financial Advisor for a comprehensive financial needs review.

.png)