-

January 16, 2020

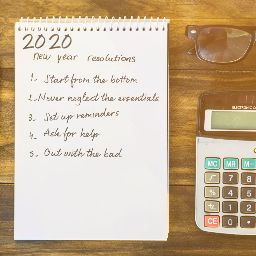

25 easy lifestyle tips to help you save money

Here are some easy, actionable tweaks to help you achieve your life goals.

-

January 09, 2020

25 simple investing tips for beginner investors

Stop putting off tomorrow what you can invest today.

-

January 07, 2020

How to Bulletproof Your Health Resolutions

By "bulletproofing" your health resolutions with these tips, you will set yourself up for long-term success and ultimately improving your physical, mental, and emotional well-being.

-

January 06, 2020

Food for Your Post-Holiday Detox

The holiday season is a time of indulgence and celebration, often filled with rich foods, sugary treats, and an abundance of alcohol. While these indulgences can bring joy and warmth during the colder months, they can also leave us feeling bloated, sluggish, and in need of a detox.

-

December 23, 2019

How to Have a Worry-Free Holiday Season

From planning gatherings to managing finances while traveling, there are countless factors that can contribute to the feeling of overwhelm during this time of year. However, with the right strategies and mindset, it is possible to have a worry-free holiday season and truly enjoy the magic of Christmas and New Year.

-

December 19, 2019

4 Tips to Stay Active Over the Holidays

Here are some tips to help you incorporate exercise into your routine this season:

-

December 11, 2019

The essence of Christmas (spending)

Have you ever vowed that you’ll never spend as much again, yet you find yourself spending more the following Christmas?

-

November 22, 2019

Have a Merry “Sustainable” Christmas: Save the Earth and your Wallet too!

From gift wrappers to actual presents, this excess of material goods could be detrimental to both our sanity and the environment.

-

October 31, 2019

Lessons from the departed

Remembering the lessons we learned from our departed, and putting them into practice is the best way to honor them.

-

October 20, 2019

Carbs: Friend or Foe?

Carbohydrates have long been a controversial topic in the world of nutrition and weight loss. On one hand, they are a vital source of energy for our bodies and are found in many nutritious foods. On the other hand, carbohydrates have been demonized as the culprit behind weight gain and various health issues.

.png)