Different personalities, different investing styles. There are countless ways for people to grow their money through investing, but at the end of the day, it will all depend on one’s characteristics and the financial habits he has gained over the years.

For instance, some view investing as a tool to generate short-term returns. Thus, they try to predict market movements then chase investment returns. This behavior usually results in frustration and disappointment because outcomes often do not translate as expected.

However, in order to achieve the full potential of one’s investing journey, long-term investing in mutual funds, and to do so for a specific goal, is ideal. As it is very difficult to predict the swings of the market, “time in the market” is more important than “timing the market.” The longer one stays invested, the bigger the potential that his money will work harder. Moreover, the earlier one invests, the better the likelihood that he can potentially enjoy returns on this capital.

Just as investing for the long-term is very important, it is also very crucial for investors to construct investment portfolios aligned with goals and with the level of risk that one is willing to take. An investment portfolio is a group of financial assets that may include investments in stocks, bonds, cash equivalents, among others. The portfolio may be directly managed by an investor or by fund managers employed by financial institutions such as Sun Life.

To build and strengthen your investment portfolio, keep in mind the following:

1. Develop a goal-oriented portfolio that is aligned with your risk profile.

Reduce risk by developing a portfolio that is able to withstand changes in market environment. This will help you pursue more stable returns for the level of risk you are willing to take.

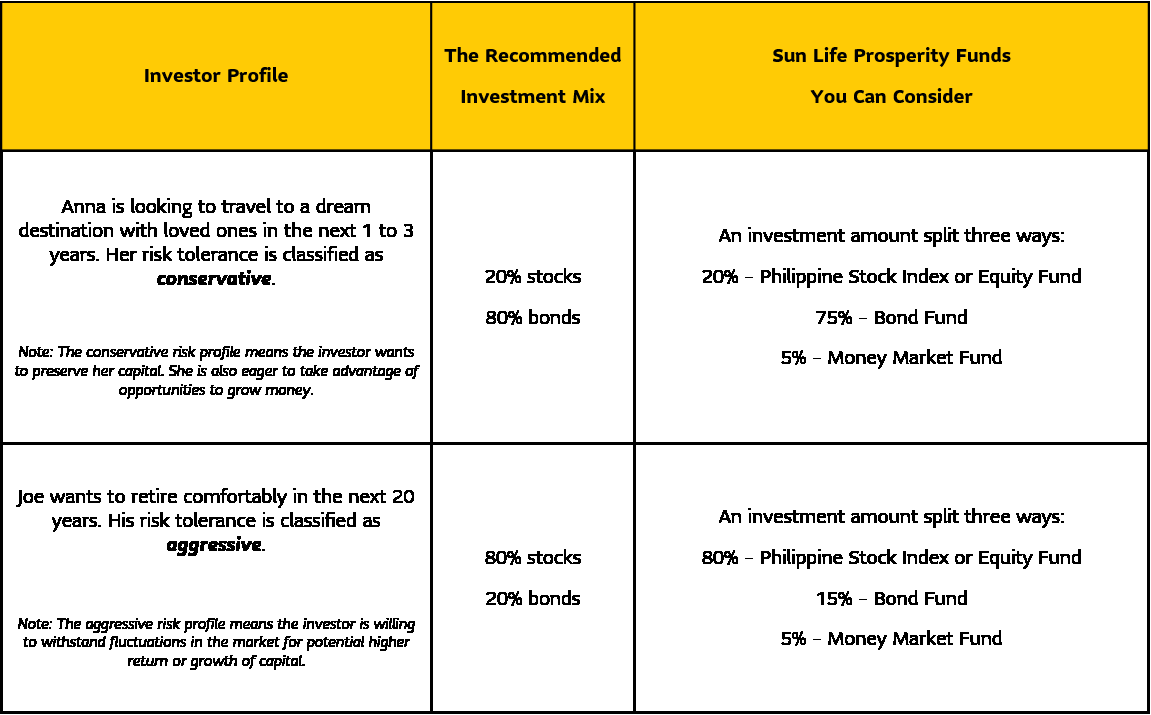

Determine your financial goals first, then assess these against your risk profile and investment horizon. You may find below sample scenarios for when you adopt a portfolio against your risk profile. Utilize the Money for Life Financial Planner to identify your investor profile.

2. Diversify and rebalance your portfolio.

Manage risks and make sure that your portfolio is not overly reliant on one stock, sector, or asset class.

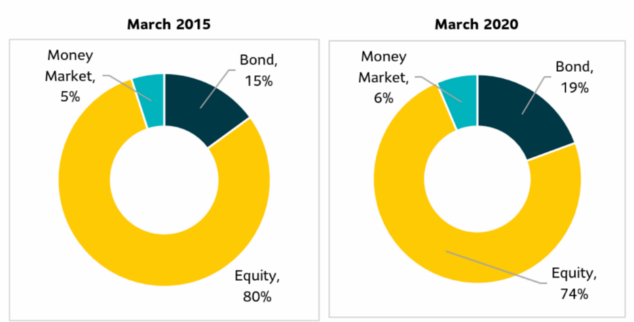

Maui instructed his financial advisor to help him create an aggressive portfolio in 2015. When Maui checked his investments five years later, his investment mix and risk level looked quite different from his initial portfolio.

Source: Bloomberg Finance L.P. “Bond” represent the Sun Life of Canada Prosperity Bond Fund, “Equity” represent the Sun Life of Canada Prosperity Philippine Equity Fund, and “Money Market” represents the Sun Life Prosperity Money Market Fund. Mutual Fund performance depends on various market and economic conditions. Past performance is not a guarantee or an indication of future results. Thus, returns are not guaranteed and may differ from the original investment.

Because Maui did not rebalance his portfolio at any time over the five-year period, he ended up with a less aggressive portfolio than what he initially intended. Although this exposes him to less risk, this also means he has less return potential for his investments.

Keep in mind that over time, your financial goals and time horizon may change due to life events, such as marriage, starting a family, or retirement. It is worthwhile to regularly assess if your risk profile is still aligned with your investment mix of stocks and bonds.

These tips are only a few of the many ways you can achieve your long-term financial goals through a more strategic approach. With the Sun Life Prosperity Funds, you can rest easy knowing your investments are managed by professional fund managers who are dedicated to ensuring that you get the best returns over the long-term.

*Sun Life Asset Management Company, Inc. (SLAMCI) makes no representation as to the accuracy or completeness of this feature article. The information contained here is subject to change without notice and should not be considered as investment advice. Past performance is not indicative of future performance. Important information about Sun Life Financial products must be obtained from Sun Life Financial Advisors or Sun Life Mutual Fund Distributors or from each one’s prospectus as seen on www.sunlifefunds.com.

With contribution from Ryan Galang

.png)