Two months ago, I set a money challenge for myself to make, save, and invest money to fund a trip to Australia. On the first month, I set a goal. On the second month, I religiously monitored my expenses and tried to increase my income.

This month, I discovered unnecessary expenses. Meron pala! All along I thought I was one of the most frugal mothers in the world but my expenses list say otherwise. Totoo pala na marami tayong malalaman just by listing down our expenses:

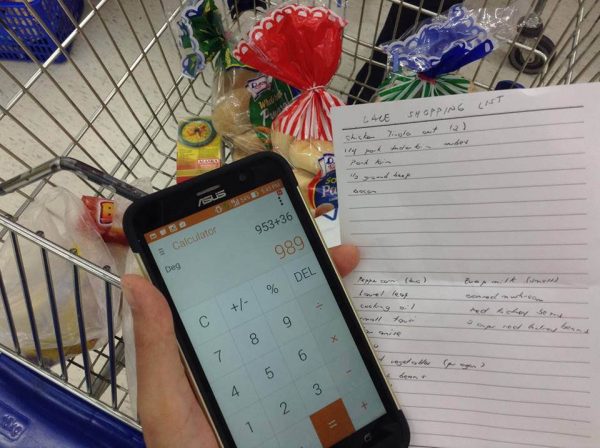

1. It helps us create a goal – how much we spend vs. how much we earn gives us an idea on how much we need to increase our income

2. It helps us create a budget – 1-2 months of listing expenses will give you a specific average amount that you spend on things like grocery, health, and work.

3. It gives us something to review and talk about – listing down expenses was a good exercise for me but better if we have a “buddy” who can do the same. I asked one of my trusted friends to do the same. Mas madali kasi magbago pag may kasama, parang pag exercise at pag-diet lang. In our case, diet on expenses.

4. It reveals spending ay’s! (expenses that could have been delayed or avoided) and yay’s! (expenses that were planned and therefore allowed savings & convenience.

Based on this money challenge experience, these are the spending pitfalls or mistakes that I made. Kung pwede lang ibalik ang nakaraan pero hindi. The good thing is, now I know and I (and you) can do better next time:

FOOD

1. Carinderia – the neighborhood carinderia sounds like a practical option for food versus fast foods and expensive restaurants. However, my expense list revealed that I relied too much on the carinderia (3x a week) – especially when I wake up late and buy our breakfast there (pancit, sopas, longganisa, etc.).

Oo P20 lang pero pwedeng maiwasan kung gigising ako ng maaga at magluluto. I also find this expense redundant when I already spend money on groceries.

2. Junk food at the sari-sari store – What’s your favorite brand of chips? Chippy ba o Nova? I am guilty of walking leisurely to my neighbor’s store to buy chips. Lalo na pag stressed sa kakahanap ng budget, totoo yan. This expense is very expensive because the price of goods at the sari-sari store is a lot more expensive compared to the grocery.

It also goes against the healthy lifestyle I try to follow and the money I pay for to use the gym. My solution is to delay impulse buying of snacks and check my own kitchen cabinet for food that I can enjoy just the same.

3. Drive through – Traffic is bad all the time and many of us know how we are likely to be stuck hungry in traffic yet don’t do anything about it. We end up driving thru fast food joints to satisfy our hunger. When I do, I don’t just buy for myself but for my companion too. Mahal na nga ang fast food, times two pa dahil bibilhan mo pa ang kasama mo.

My resolution is to bring snacks aka pantawid gutom when travelling. If you bring your own car, you can do it better because you can leave x amount of snacks and drinks inside the vehicle. I now bring water and snacks every time – whether traveling by car, taxi, or bus.

Grocery

1. Falling for Buy 1 Take 1 – deals are good but recently, I wasted P200 on buy 1 take 1 meat that turned out spoiled. I won’t mention the supermarket but just be careful of buying frozen meat. They don’t smell when frozen but finally when I decided to cook sinigang, the meat smelled terrible and I know right away it was not good to eat. Not only did I waste money (P200) but also time and LPG. Buti nalang hindi ko pa nalagyan ng gulay!

Health

1. Unnecessary supplements – everyone wants to look their best. So when I had extra money, I made an unplanned purchase of a “glowing” supplement for my skin. Little did I consider how expensive it was and that I cannot afford to use it long term. I knew it after looking at the expenses list – the cost of this supplement was equal to my groceries for 4 weeks!

Instead of continuing with this supplement, I discovered it would be cheaper by 50% to get a regular facial every month (mas relaxing pa) and to continue eating fruits & vegetables.

2. Emergencies & Medicines – I am lazy to bring a first aid kit but now I know not bringing one is not just expensive but dangerous. My son and I recently spent a weekend swimming and right after, he suffered from high fever. I did not bring any medicines with me so I had to walk far and buy fever medicine which we have many at home.

Also a few weeks ago, I suffered from migraine and without medicine within reach – I had to endure the pain and did not enjoy the activity I was participating in. So fellow mommies, I know it can be a hassle and also heavy to bring medicines for the entire family but have this in your bag especially on trips:

– Fever medication for kids to last at least 3 days – Paracetamol for adults – Iodine solution, cotton, and band aid or gauze with medical tape – Sun block – Medicine for LBM, hyper-acidity – Relief balm (Vicks) and soothing oil for stomach & muscle pains

I remember last year, my husband hurt himself during an outing. He was wounded yet had to walk to the pharmacy to buy Iodine solution, cotton, and gauze for his wound. Not having a first aid kit wastes money, time, and enjoyment.

Utilities

1. Internet – I subscribed to a higher plan with “faster” speed but now that my sister is away, I could have stayed with our old plan and saved money. Now it’s inconvenient to downgrade, especially with the many downgrade fees the telco is asking.

2. Cable – Just a few months ago, I renewed our cable subscription. We have the most basic plan but guess what? The only cable channel we watch is Disney Junior, the other channels are never seen. Sayang naman. Next year, I will cancel our subscription and ask my son to watch YouTube instead. There are now legal streaming apps like NetFlix and iFlix. Meron ding cartoons dito at pwede pa panoorin anytime.

Ikaw, what have you discovered by listing down your expenses?

Sample Budget

If you are following the habit of listing down expenses and have weeded out spending pitfalls, the remaining figure becomes a picture of what your budget can look like. Maybe you want to stick with the figures or create a new one by reducing, re-allocating, or adding to it.

This exercise gives us a realistic budget that we have the best ability to keep. Here is my monthly budget which I intend to follow moving forward. Sa totoo lang, budgets are very hard to share because as with other money matters, budgets are very personal. But, I really want to share the reality I am in and hopefully, inspire other moms to spend time in creating their own budget.

With this budget, we have the ability to command our hard earned income of where they should go.

| Category | Budget |

| Grocery | P4,000 |

| Transportation | P2,000 |

| Health *inclusive of PhilHealth | P1,900 |

| Restaurants or dining out | P500 |

| Recreation | P500 |

| Electricity | P5,000 |

| Internet | P1,500 |

| Communication *Prepaid load only | P200 |

| Water | P600 |

| Childcare (nanny fees) | P4,000 |

| Total Expenses | P20,200 |

For an ordinary mother like me P20,200 is huge and scary, to think that this figure is exclusive of impulse purchases. I wish I can have more budget for me and my son’s recreation and dining out, but it’s better to have food on the table. We can always enjoy later or maybe save up the budget for a one time but bigger and more enjoyable outing. Maybe in the next months I can come up with ways to reduce these expenses.

Looking at how much we need in order to live is really overwhelming, nakakatakot talaga. But you know what is more frightening? Waking up one day not knowing where all our money went and having nothing to spend. Creatively increasing my income really helped, read here. Every week, I clean the house and look for things we no longer need and use them to fund our expenses. Just this week, I made P850 selling my son’s old clothes and there are plenty left.

Selling stuff we no longer use might be a temporary solution. Options like working full time, switching jobs, and maybe quitting some become apparent. At least now we have something to talk about and with substantial information on our hands.

The changes we need to take might be painful and involve sacrificing time with family. After all, it can be said that saving or investing is foregoing something good for now, to gain something better in the future. The important thing is how we can all improve and be smarter in our journey to being financially independent, worry-free, and having enough money for life. Kaya natin yan!

.png)