INCOME PROTECTION

Life Insurance helps address your income continuation needs. Its cash benefit replaces income if someone is unable to work due to sickness or injury, or provide for a family’s needs in the event of death.

Ideal for:

| Getting Started | Moving Up | Preparing Ahead |

Always follow this rule of thumb:

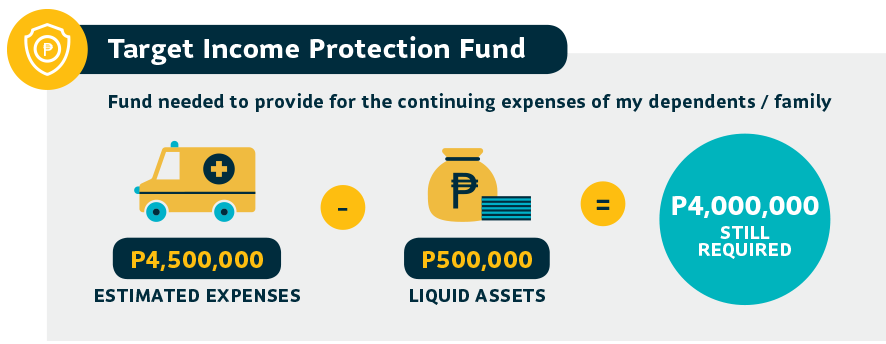

ESTIMATED EXPENSES less LIQUID ASSETS =

INCOME PROTECTION FUND

ESTIMATED EXPENSES include the total of:

- All debt (unsecured loans, credit card balances, personal loans, etc)

- Estimated final expenses (funeral costs)

- Annual share in household expenses multiplied by # of years needed to sustain family

EXISTING LIQUID ASSETS include the total of all savings & investments, and life insurance coverage.

Download the Target Income Protection Fund worksheet here.

HEALTH PROTECTION

Insurance can also be a safety net for health-related concerns. An Illness not only affects you physically, but financially as well. When this happens, reaching your goals and dreams in life become more challenging.

Ideal for:

| Getting Started | Moving Up | Preparing Ahead | Leaving A Legacy |

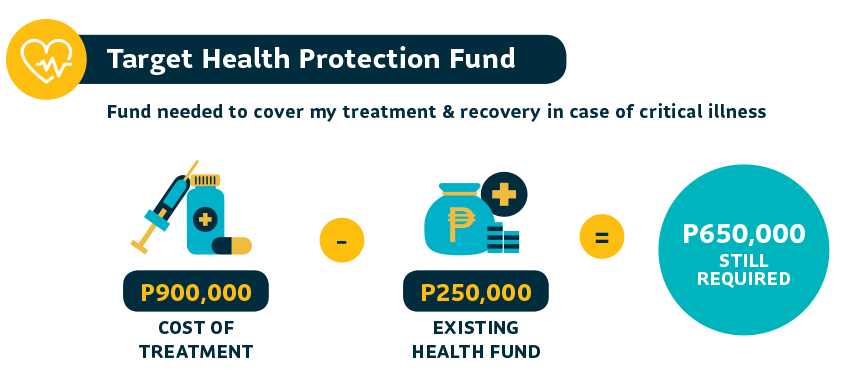

Always follow this rule of thumb:

COST OF TREATMENTS less EXISTING HEALTH FUND =

TARGET HEALTH PROTECT FUND

Download the Target Health Protection Fund worksheet here.

The calculations are for reference and illustration purposes only and does not constitute a proposal, solicitation or financial advice. Sun Life makes no representation or warranties as to its completeness or accuracy, nor is it responsible for any consequent loss or damage that may arise from its usage.

You may talk to a Sun Life Financial Advisor for a comprehensive financial needs review.

.png)