Hear it straight from financial gurus Randell “Mr. No-Nonsense Finance” Tiongson and Marvin “Mr. Stock Smarts” Germo: a good financial portfolio is similar to a balanced meal.

Traditional instruments such as savings account and time deposits serve as staples, like rice. Insurance can be the sidings, like vegetables. And when it comes to investments, you must diversify like viands or main dishes.

BALANCE is key, too much of one portion leads to an unhealthy diet. Staples give you energy or liquidity to meet immediate needs. Sidings must be nutrient-dense to ensure longevity. And for main dishes, you need to consume it in moderation. But it is important to consider your lifestyle in order to achieve security and stability.

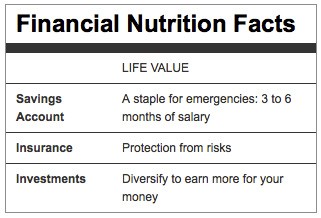

In a nutshell, a balanced financial portfolio looks like this:

Remember: there’s no such thing as a best portfolio. But you can definitely find one that best fits your needs and how you live your life.

Here are some things to keep in mind when putting together your own financial portfolio:

- Allocate assets properly

- Diversify in line with your goals

- Be flexible because your needs may change in a matter of years.

.png)